A Sharper Perspective on Global Bond Markets.

-

The 38 Trillion Dollar Reckoning: US Fiscal Dynamics and the Term Premium Repricing

Fixed income markets overlook a fiscal crisis. G7 nations face a massive refinancing burden. High interest rates create unsustainable debt levels. Bonds are no longer safe assets. Shift your strategy. Reduce duration risk. Monitor term premiums.

-

The Death of Bond Market Liquidity

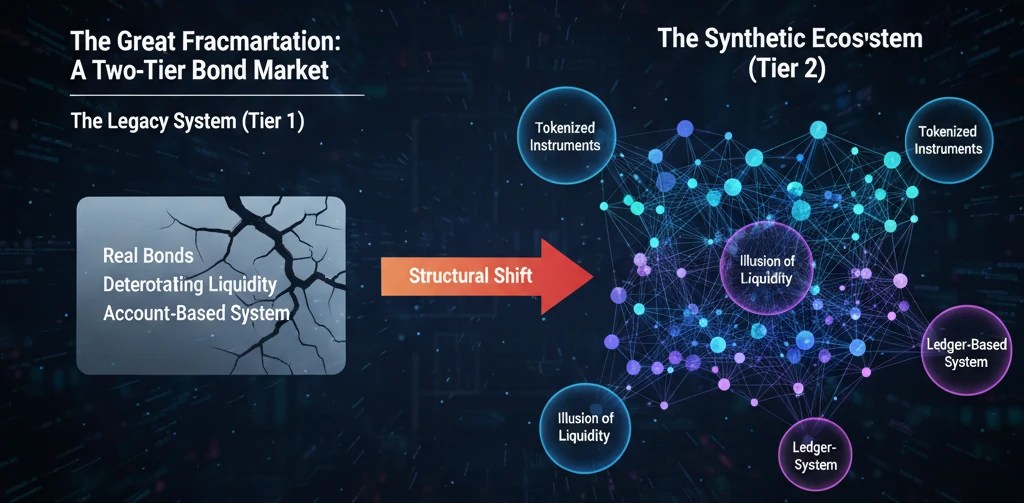

How a Three-Act Crisis Forged a Fractured, Two-Tier Financial System For decades, global capital markets have rested on a fundamental assumption: the U.S. Treasury market is the ultimate risk-free haven, underpinned by limitless liquidity. This assumption, once the bedrock of portfolio construction, is now a perilous illusion. Beneath a veneer of superficial stability, bond market…

-

The Tokenization of Fixed Income: How Blockchain Will Revolutionize Secondary Market Liquidity and Product Structuring

The fixed income market operates on antiquated infrastructure. This deep-dive analysis explores how tokenization is not just a technical upgrade, but a revolution set to solve chronic illiquidity and unlock unprecedented efficiency through fractionalization and smart contracts.

-

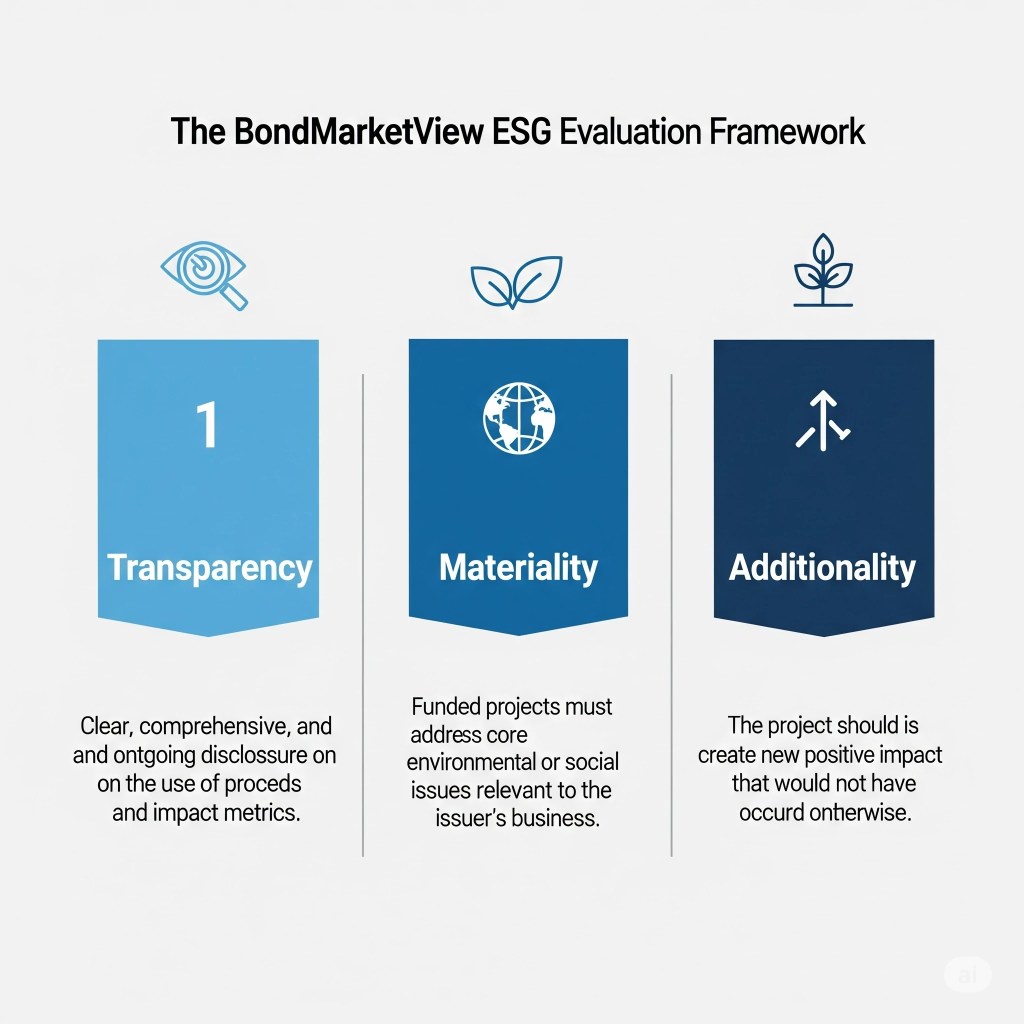

The Strategist’s Guide to ESG Bonds: From Impact Measurement to Sustainable Alpha

In the trillion-dollar ESG bond market, how can you distinguish real impact from “greenwashing”? This guide presents the BondMarketView framework for evaluating ESG bonds, linking rigorous analysis to sustainable financial outperformance.

-

Beyond the Yield Curve: A New Model for Market Analysis

The traditional yield curve is no longer a reliable guide. This analysis introduces a new model that looks beyond simple inversion to the deeper structural forces, like demographics and technology, that are truly shaping the next decade of bond markets.