The global ESG bond market has firmly established itself as a cornerstone of modern finance. With issuance hitting the symbolic $1 trillion mark for the second time in 2024, the sheer scale of this market is undeniable. Green bonds continue to dominate, accounting for approximately $672 billion of the total, a 9% year-over-year increase, reflecting an unyielding demand for climate-focused investments.

Yet, this explosive growth has brought with it a significant challenge: the pervasive risk of “greenwashing.” For the informed investor, navigating this landscape requires more than just a thematic preference for “green” projects. The key to successful ESG bond investing, and the core argument of this article, is the application of a rigorous, analytical framework that moves beyond labels to measure real-world impact, mitigate reputational risk, and ultimately, unlock sustainable financial outperformance, or “alpha.”

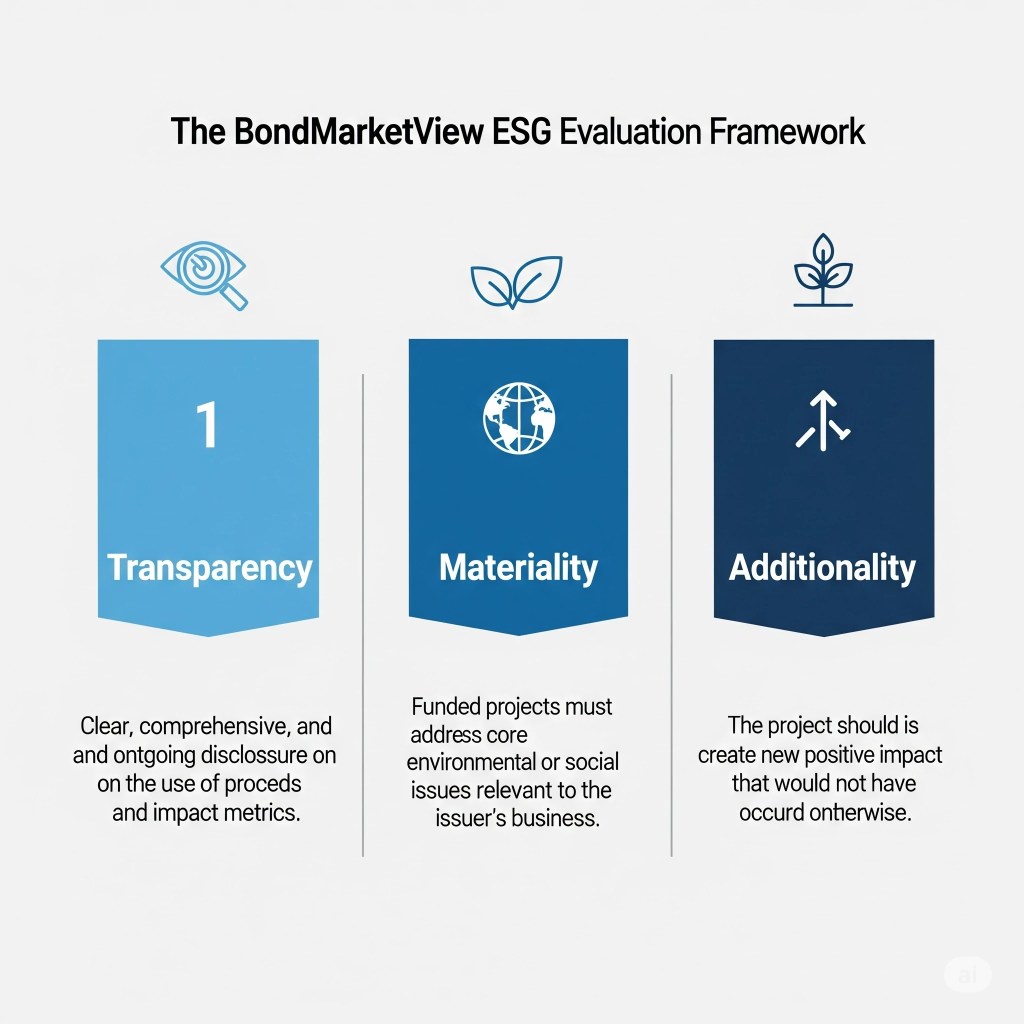

The BondMarketView Framework: A Disciplined Approach to ESG Evaluation

In a market crowded with issuances of varying quality, a disciplined evaluation framework is essential. At BondMarketView, we advocate for a three-pronged approach focused on Transparency, Materiality, and Additionality.

- Transparency: This goes beyond simply labeling a bond “green” or “social.” It requires clear, comprehensive, and ongoing disclosure. Investors should demand granular reporting on the use of proceeds, the specific projects being funded, and the metrics used to track their impact. Post-issuance reporting is not a “nice-to-have”; it is a critical component of a credible ESG bond.

- Materiality: The funded projects must address environmental or social issues that are material to the issuer and its stakeholders. For example, a green bond from a utility company focused on renewable energy infrastructure has high materiality. In contrast, a bond from the same company to fund energy-efficient lighting in its corporate offices, while positive, is less material to its core business and overall environmental impact.

- Additionality: This is perhaps the most crucial and often overlooked element. A high-quality ESG bond should fund projects that would not have been undertaken otherwise. It should create additional positive impact, not simply refinance existing “green” assets. This concept challenges investors to ask the tough question: Is this bond truly creating a more sustainable future, or is it merely a marketing exercise?

A Tale of Two Bonds: A Comparative Case Study

The difference between a high-quality ESG issuance and a controversial one often lies in the rigor of its framework.

The Gold Standard:

Recent examples of successful ESG bonds highlight the importance of our framework. The New Development Bank’s (NDB) USD 1.25 billion green bond, issued in November 2024, is a case in point. Its success is underpinned by NDB’s Sustainable Financing Policy Framework, which provides a robust and transparent process for project selection, evaluation, and reporting. Similarly, the Societe des Grands Projets’ (SdGP) EUR 1 billion green bond for the Grand Paris Express metro project, which was 17 times oversubscribed, benefits from certification under the Climate Bonds Standard, a globally recognized benchmark for best practices. The Dominican Republic’s debut sovereign green bond also stands out. The USD 750 million issuance, which was six times oversubscribed, funds a range of clean energy, transportation, and waste management projects, and was priced approximately 15 basis points cheaper than comparable non-thematic issues, signaling strong market confidence.

The “Greenwashing” Trap:

On the other end of the spectrum are bonds that, while labeled “green,” face criticism for a lack of transparency and impact. While specific “infamous” bonds are often hard to pinpoint in a given year, a pattern of “greenwashing” concerns has emerged, particularly in some rapidly growing but less regulated markets. Analysts have pointed to instances where a significant portion of green bond proceeds, in some cases up to 50%, have been allocated to general working capital or projects with questionable environmental benefits. This misallocation, coupled with a lack of alignment with international standards like the Climate Bonds Initiative, erodes investor confidence and undermines the integrity of the market. These examples highlight the critical importance of due diligence and a skeptical, analytical approach.

From Impact to Alpha: The Financial Case for High-Quality ESG

The link between robust ESG practices and financial performance is no longer a matter of debate; it is a data-driven reality. Recent academic studies and financial reports from 2024 and 2025 provide compelling evidence of this correlation.

A July 2024 study of publicly listed Chinese companies found that strong environmental and social ESG practices significantly reduce corporate credit risk. Another 2024 study of European banks confirmed that ESG factors have a tangible impact on credit ratings from major agencies. For portfolio managers, the implications are clear: a 2024 study of corporate bond portfolios from 2013-2020 found that portfolios with the highest ESG scores were significantly less exposed to credit risk.

The story doesn’t end with risk mitigation. A 2025 study of Chinese A-share listed companies from 2009 to 2022 demonstrated that better ESG performance significantly boosts financial returns. This aligns with broader meta-analyses, with approximately 58% of studies showing a positive relationship between ESG and financial returns.

Implications for Investors

The evolving ESG bond market presents different opportunities and challenges for various investor types:

- For the Pension Fund Manager: The long-term, liability-driven nature of pension funds aligns perfectly with the risk mitigation characteristics of high-quality ESG bonds. The focus should be on building a core holding of highly-rated, transparent, and impactful bonds that can provide stable, long-term returns.

- For the Active Credit Manager: The inefficiencies and information asymmetries in the ESG bond market create opportunities for alpha generation. By applying a rigorous analytical framework, active managers can identify mispriced bonds and avoid those with high “greenwashing” risk.

- For the Retail Investor: The proliferation of ESG-focused ETFs and mutual funds has made this market more accessible. However, retail investors should look beyond the fund’s name and examine its methodology for selecting bonds. A fund that prioritizes transparency, materiality, and additionality is more likely to deliver on both its impact and financial goals.

Conclusion & Outlook

The ESG bond market has matured from a niche segment to a mainstream asset class. As the market continues to evolve, the ability to distinguish between genuine impact and “greenwashing” will be the defining characteristic of a successful investment strategy. The data is clear: a disciplined, analytical approach to ESG bond investing, focused on transparency, materiality, and additionality, not only contributes to a more sustainable future but also leads to superior, risk-adjusted returns.

Looking ahead, we are watching several key trends. Regulatory scrutiny is set to increase, with a greater push for standardized disclosure and reporting requirements. The development of more sophisticated impact measurement methodologies will also be crucial. And as the market continues to grow, the ability to source high-quality, impactful projects will become an increasingly important differentiator. For the astute strategist, the ESG bond market is not just about investing in a better world; it’s about investing intelligently in the world of tomorrow.

Leave a comment