For decades, the fixed income market has been the bedrock of global finance, yet it operates on infrastructure that can only be described as antiquated. This “antiquated plumbing” has created deep-seated, structural problems, particularly chronic illiquidity and high transaction friction in key sectors. Recent data from 2024-2025 starkly illustrates this reality: the average transaction cost for municipal bonds has soared to approximately 50 basis points, a persistent elevation that has outlasted multiple market crises. Odd-lot trades in this sector face even higher spreads of 56 basis points. Meanwhile, the burgeoning $2.5 trillion private credit market faces its own crisis of opacity and illiquidity, with no secondary market exit options for most investors.

Against this backdrop, the tokenization of fixed income is emerging not as a mere technical upgrade, but as a fundamental infrastructure shift. It is a revolution poised to solve the market’s two historical weaknesses, unlocking unprecedented efficiency, democratizing access, and enabling a new wave of product innovation. For institutional investors, ignoring this transformation is no longer an option.

Tokenization Explained: The “Digital Twin”

At its core, tokenization is the process of creating a “digital twin” of a real-world asset, such as a bond, on a blockchain. This digital token represents legal ownership of the underlying security. Each token is a programmable, cryptographically secure digital record that contains all the rights, features, and legal obligations of the traditional bond. This digital representation lives on a distributed ledger, a shared and immutable database that allows all authorized participants to see the same version of the truth simultaneously, eliminating the need for complex, siloed reconciliation processes.

The Primary Solution: Solving the Liquidity Puzzle

The most profound impact of tokenization is its ability to solve the market’s chronic liquidity problem, primarily through fractionalization. By creating a digital representation of a bond, issuers can divide it into smaller, more affordable units. This is not a theoretical benefit; it is already happening.

Platforms like BondbloX, the world’s first regulated fractional bond exchange, are breaking down traditional bonds with 200,000 minimums into $1,000 fractional units, enabling 200 times greater diversification. Similarly, Singapore’s **OCBC Bank** now offers customized tokenized bonds in S$1,000 denominations, a stark contrast to the traditional S250,000 minimums.

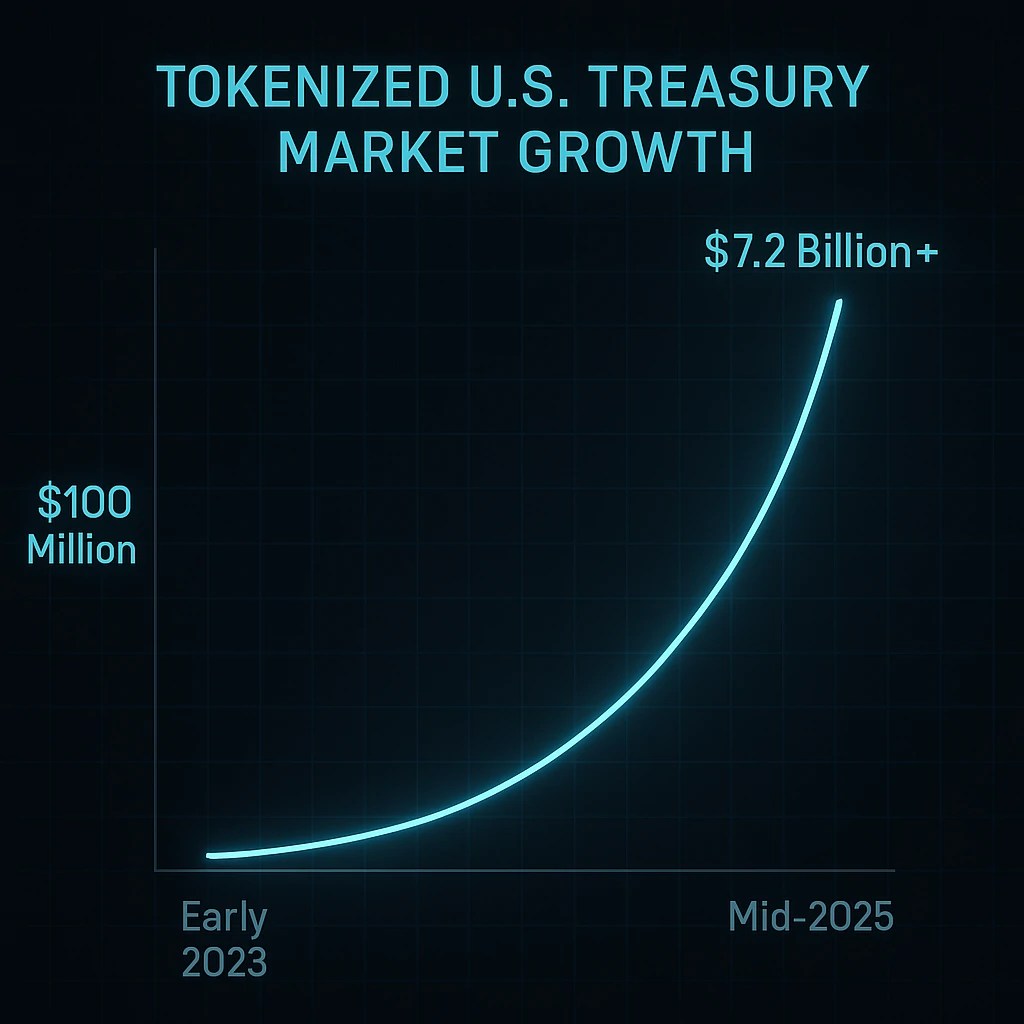

This fractionalization dramatically expands the pool of potential investors beyond large institutions, bringing new capital and liquidity into previously inaccessible markets. The early success in the most liquid asset class—U.S. Treasuries—serves as a powerful proof of concept. The tokenized Treasury market has surged from under $100 million in early 2023 to over $7.2 billion by mid-2025, with institutional giants like BlackRock, Franklin Templeton, and Fidelity all launching tokenized money market funds.

Beyond Liquidity: Efficiency and Innovation

While enhanced liquidity is the headline benefit, the secondary advantages of tokenization are equally revolutionary.

1. Atomic Settlement and Operational Efficiency:

The traditional bond market is plagued by multi-day settlement cycles (T+2 or longer), which introduce counterparty risk and operational friction. Tokenization enables “atomic settlement,” where the transfer of the asset and the payment occur simultaneously and instantly (T+0). The results from institutional pilots are compelling:

- Goldman Sachs, through its GS DAP platform, achieved same-day (T+0) settlement for a €100 million digital bond issued by the European Investment Bank (EIB).

- HSBC’s Orion platform reduced the settlement cycle for a multi-currency digital bond from T+5 to T+1, a dramatic four-day improvement.

This efficiency eliminates settlement risk, automates manual processes, and significantly reduces the costs associated with intermediaries like clearinghouses and custodians.

2. Product Innovation through Smart Contracts:

Tokens are programmable. The terms and conditions of a bond can be embedded into a smart contract, which automatically executes actions like coupon payments and maturity redemptions. This automation eliminates errors and operational overhead. More importantly, it opens the door to unprecedented product innovation. Imagine complex structured products with automated, rules-based triggers or ESG bonds where compliance metrics are automatically tracked and reported on-chain. JPMorgan’s Project Guardian demonstrated this potential by using tokenization to enable mass-scale, customized portfolio construction across traditional and alternative assets, a task previously unfeasible for the wealth management industry.

A Balanced View: The Hurdles to Widespread Adoption

Despite the clear potential, the path to a fully tokenized fixed income market is not without significant obstacles. The primary challenges are regulatory and technical.

The regulatory landscape remains fragmented and uncertain. In the U.S., the SEC under Chairman Paul Atkins has launched “Project Crypto” to create a more crypto-friendly framework, yet fundamental questions persist. As Commissioner Hester Peirce stated:

“tokenized securities are still securities”

This means they are subject to all existing laws. Key hurdles include:

- Custody Requirements: The SEC’s Customer Protection Rule (Rule 15c3-3) was not designed for digital assets, creating uncertainty for broker-dealers on how to custody tokens compliantly.

- Transfer Agent Rules: It remains unclear whether a blockchain ledger can serve as the authoritative record of ownership, and who—from software developers to validators—might be deemed a transfer agent.

- Cross-Border Fragmentation: The European Union’s DLT Pilot Regime has seen slow adoption, while the UK is developing its own sandbox. This lack of international harmony creates significant compliance costs for global institutions.

These legal ambiguities force many innovative projects offshore and slow the pace of institutional adoption.

The New Competitive Landscape: Winners and Losers

This technological shift will create clear winners and losers across the financial ecosystem:

- Investment Banks: Institutions like Goldman Sachs, JPMorgan, and HSBC are moving from pilots to building out proprietary platforms (GS DAP, Kinexys, Orion). Their role will evolve from intermediaries to technology providers, offering tokenization-as-a-service and creating new digital market infrastructure.

- Asset Managers: The ability to offer fractionalized access to illiquid assets like private credit and to build highly customized, automated portfolios will become a key competitive differentiator.

- Issuers: Tokenization offers access to a broader, more global investor base and significantly lower issuance costs, making it particularly attractive for smaller issuers in fragmented markets like municipal finance.

Conclusion & Outlook: The Trillion-Dollar Opportunity

The tokenization of fixed income is not a question of if, but when and how fast. The inefficiencies of the current system are too great to ignore, and the benefits of the new infrastructure are too compelling. While regulatory hurdles will ensure the transition is gradual, the direction of travel is clear.

Forecasts for the size of the tokenized asset market by 2030 vary widely, but the scale is consistently monumental. The Boston Consulting Group (BCG) projects a $9.4 trillion market, McKinsey offers a more conservative $2 trillion estimate, while Citi forecasts $4-5 trillion. The median forecast of a nearly $10 trillion market represents a potential 40-fold increase from today’s levels.

This is more than an incremental improvement; it is the dawn of a new, more efficient, and more accessible financial architecture. The institutions that invest in understanding and adopting this technology today will be the ones that define the future of capital markets.

Leave a comment