How a Three-Act Crisis Forged a Fractured, Two-Tier Financial System

For decades, global capital markets have rested on a fundamental assumption: the U.S. Treasury market is the ultimate risk-free haven, underpinned by limitless liquidity. This assumption, once the bedrock of portfolio construction, is now a perilous illusion. Beneath a veneer of superficial stability, bond market liquidity is not evolving—it is dying, replaced by a synthetic ecosystem that fundamentally redefines systemic risk.

Act I: The Tremor – A Microstructural Warning Shot

The deterioration began with a profound tremor in the market’s core infrastructure. The April 2025 Treasury market liquidity crisis, following a surprise tariff announcement, was not a fleeting anomaly but a clear warning shot. The Federal Reserve Bank of New York documented a severe breakdown, with key metrics rapidly nearing or exceeding the stress levels of the March 2023 banking crisis.

The damage was precise and alarming:

- Bid-ask spreads for longer-term off-the-run Treasuries and TIPS “jumped quickly and approximately doubled in size.”

- Market depth in the benchmark 10-year security “declined to about one-quarter of recent levels.”

- The TIPS liquidity premium surged by 30 basis points in a single week—”a magnitude highly unusual in such a short time.”

Most unsettling was the breakdown in traditional safe-haven behavior. While Treasuries initially rallied, the effect was short-lived. Yields began climbing in subsequent sessions as government bonds fell in value alongside equities. This decoupling exposed a fragility that the Federal Reserve’s own research had presciently warned of just months earlier, noting that reduced “market depth” critically increases dependence on the “prompt replenishment of resting orders”—a dependency that proved tragically fragile.

This microstructural fragility, while alarming, was merely a symptom. The true danger lay in the fact that the system’s primary shock absorber was about to disappear.

Act II: The Drain – A System Without a Safety Net

The second act of the crisis was the exhaustion of the Federal Reserve’s overnight reverse repo (ON RRP) facility. By August 2025, cash flowing into the facility had fallen to near-zero for the first time in years. This was not a technical normalization; it was the removal of a crucial systemic stabilizer. As Bloomberg noted, with the RRP’s cushion gone, repo markets became “more vulnerable to swings in Treasury issuance.”

The NY Fed’s own research had identified four critical early warning signals of reserve scarcity, all of which flashed red in early 2025. The consensus among analysts like JP Morgan was clear: the exhaustion of the ON RRP is not a sign of health, but “the removal of a systemic stabilizer.” With Treasury issuance elevated and M2 growth stagnant, the domestic financial system was left exposed and brittle.

Into this void of traditional liquidity and dwindling reserves, a new, powerful, and poorly understood force began to proliferate, promising a solution while masking a deeper fragmentation.

Act III: The Proliferation – A Synthetic Solution with Systemic Flaws

The third act is the explosive, and largely opaque, expansion of a synthetic market. The tokenized government bond market surged past $6 billion in 2025, led by BlackRock’s BUIDL and Franklin Templeton’s BENJI. The broader tokenized asset market hit $24 billion, with projections nearing $30 trillion by 2034.

The Bank for International Settlements (BIS) has embraced this shift, with its “Project Agorá” testing a “trilogy of tokenized central bank reserves, commercial bank money and government bonds.” Yet, even the BIS admits that current structures “fall short” and face “significant challenges,” including fragmentation.

Crucially, academic research from September 2025 confirms these fears. The paper, “Tokenize Everything, But Can You Sell It?”, documented that despite the promise of 24/7 markets, “most RWA tokens exhibit low trading volumes, long holding periods, and limited investor participation.” The reasons cited are structural: regulatory gating, custodial concentration, and a lack of decentralized trading venues. This new tier, built to solve a problem, has introduced an entirely new architecture of risk.

The Consequence: A Two-Tier System and the Fragmentation of Finance

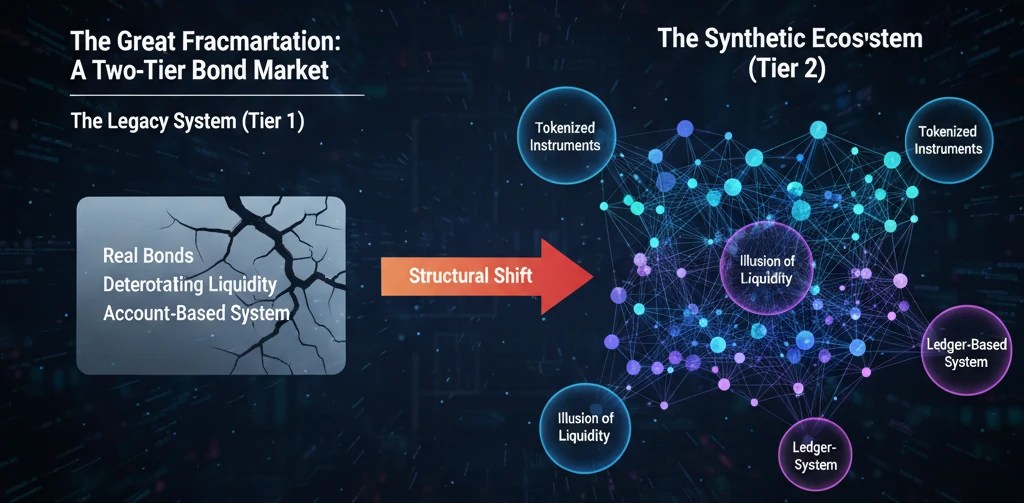

The convergence of these three crises has forged an unprecedented two-tier system in global fixed income.

The First Tier, the legacy account-based system, is a shrinking core of “real” bonds suffering from deteriorating liquidity. The stress events of April 2025 are a preview of its future: a brittle and unpredictable market where depth can vanish instantly.

The Second Tier, the new ledger-based system, is an expanding universe of synthetic instruments. It offers the illusion of perpetual accessibility but is plagued by structural barriers, valuation opacity, and concentrated points of failure.

The global fixed income market is no longer a monolith. It is fragmenting into distinct, often incompatible, liquidity architectures. What constitutes “liquidity” in one tier may not translate—or even exist—in the other, creating systemic disconnects that regulatory frameworks are unequipped to handle.

The CIO’s Dilemma: Navigating a World Without a True Haven

The empirical evidence is conclusive: traditional bond market liquidity is not merely evolving; it is dying. It is being supplanted by a synthetic ecosystem that generates an illusion of liquidity while concentrating systemic risk in ways that make previous financial crises appear almost predictable. The April liquidity event, the near-zero RRP, and the fragmented growth of tokenized instruments are not isolated data points. They are symptoms of a profound, irreversible structural transformation.

For Chief Investment Officers and portfolio managers, this necessitates an immediate re-evaluation of established models. The frameworks built upon a robust sovereign bond market are becoming obsolete. The questions now are not merely about managing duration or credit, but about the very nature of liquidity itself: How do strategies adapt to a bifurcated market where traditional depth is compromised and synthetic alternatives carry unquantified risks?

What new tools are required to navigate this

Leave a comment